Description

Stay compliant and stay ahead with our streamlined OR WD report filing solutions, designed to simplify the process and keep your business on track for success.

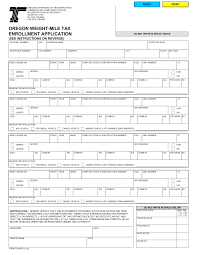

The Oregon Weight-mile tax applies to vehicles in commercial operations on public roads within Oregon with a registered weight over 26,000 pounds. Motor carriers:

-

With established accounts must enroll all weight-mile tax qualified vehicles under the account and pay the weight-mile tax on a tax report.

-

Without an established account must purchase and carry a temporary pass, and be able to produce a legible paper or electronic copy.

-

Are responsible for all tax enrolled vehicles under the account, including leased or rented vehicles.

Non-refundable. Monthly tax fee and 3% processing fee applies.

Reviews

There are no reviews yet.